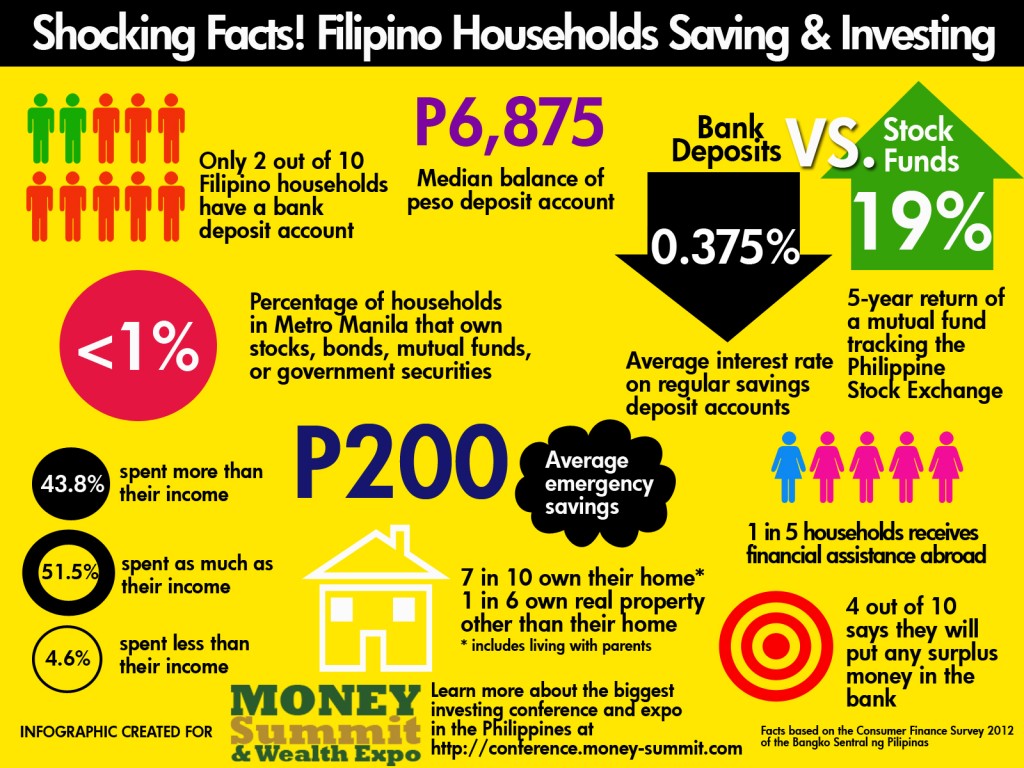

Shocking facts about saving and investing for Filipino households

We recently released an infographic called “Shocking Facts! Filipino Households Saving & Investing” and it has caught fire on social networks, particularly Facebook, where it has been liked, commented on, and shared by hundreds of Filipinos truly shocked by the stats.

Below is the press release of the BSP on their first Consumer Finance Survey, on which most of the data in the infographic was based on.

BSP Releases Results of First Consumer Finance Survey in the Philippines

The Bangko Sentral ng Pilipinas has released the results of the first Consumer Finance Survey (CFS) in the Philippines. The CFS generates data on the financial conditions of households, including what they own (financial and non-financial assets) as well as from whom and how much they borrow (sources of credit and level of indebtedness). It also generates data on the income, spending and insurance coverage of households. The survey results also provide a breakdown of respondents residing in the National Capital Region (NCR) and in Areas Outside the National Capital Region (AONCR).

The survey has a sample size of 10,520 households consisting of 3,872 households (36.8 percent) from the NCR and 6,648 households (63.2 percent) in AONCR, specifically Regions 1, 7, and 11. The overall response rate was 89.4 percent.

Reference periods for the data collected from the survey vary. For data pertaining to demographics, assets and liabilities, and preferences and behaviors, the reference period was the date the household was interviewed (i.e., within the period from November 2009 to January 2010), while for data on work, income and expenditures of households, the reference period was the full year 2008. The survey respondent is the member of the household that is most knowledgeable about the household’s finances. The survey respondents were predominantly female (59.8 percent), in the working age bracket of 21-64 years old (85.7 percent), and were high school or college graduates (55.2 percent).

CFS results indicate a significant increase in the country’s labor force over the next decade

The Philippines has a young population. The age distribution of household members showed that 21.5 percent were 5-14 years old, while those who were about to retire or were close to compulsory retirement (aged 55-64 years old) and the elderly (65 years old and over) accounted for 6.9 percent and 5.4 percent of the household members, respectively, at the time of the survey. These figures also indicated that a significant increase in the country’s labor force could be expected over the next decade given that a much bigger number of young people could enter the labor force every year compared to the number of older people who leave the labor force working age group. Thus, the age dependency ratio, currently estimated at 0.6, could further drop to 0.5, translating to about two working age household members for every one non-working age household member.

Home appliances, own residence and retirement insurance are the most common types of assets owned by households

The three most common assets held by households were home appliances (87.1 percent of all households), their own residence (68.8 percent) and retirement insurance (42.7 percent). A smaller percentage of households owned motor vehicles (24.3 percent), deposit accounts (21.5 percent), other real property apart from respondent’s residence such as land, house and lot, and farm (16.2 percent) and precious objects (14.9 percent). Only a very small percentage of households owned securities and investment accounts such as stocks, bonds, mutual funds and unit investment trust funds (0.4 percent).

Household liabilities are in the form of consumer and real property loans

With respect to liabilities, few households had outstanding loans on their residence (3.7 percent) and other real property (5.8 percent). A bigger percentage of households had outstanding consumer loans such as motor vehicle loans (13.5 percent); personal, salary, all purpose loans (20.9 percent); and credit card loans (3.9 percent).

The main sources of funds of households vary by type of loan. These included government housing institutions and money lenders for real estate loans; in-house financing for motor vehicle and appliance loans; banks for credit card loans; and money lenders and cooperatives for other loans.

Seven in ten households own their homes

For many households, the main asset that they hold is their home. About 68.8 percent of households were homeowners (38 percent own/co-own their house and lot and 30.8 percent own/co-own their house only). The rest (31.2 percent) were broken down as follows: renting (13.0 percent), neither owned nor rented their housing unit (18.0 percent), and did not respond (0.2 percent). This indicated that a significant number of families lived with relatives or were part of extended families.

Housing is acquired largely through cash payment or inheritance and a small percentage through borrowings

Most households that owned their house/house and lot acquired the property through cash payment and inheritance/gift. A small percentage of households acquired their residential property through the Comprehensive Agrarian Reform Program (CARP). Only 6.7 percent borrowed money for their housing.

Government institutions are the primary source of housing loans

Government institutions were the most popular providers of housing loans, followed by cooperatives and money lenders. Other sources of credit were rural/cooperative banks, commercial banks, former owner of the property, financing institutions, savings and thrift banks and company/employer loan.

Seven in ten households pay an annual interest rate of ten percent or lower on housing loans

In terms of lending rates, majority of households (73.4 percent) paid an annual interest rate of 10 percent and below on their housing loans while 14.1 percent were charged interest rates of 11-20 percent per annum. The remaining households were charged with an interest rate ranging from 21 percent up to 60 percent.

One in two households with outstanding housing loans pay ahead or on schedule

Almost one-half of households with outstanding loans paid their monthly amortization either ahead of or on schedule, while the other half were behind schedule.

One in six households owns other real property

About 16.2 percent of households owned at least one other real property aside from their residence.

Money lenders are the primary source of loans for other real property acquisitions

Money lenders were the most popular providers of other real property loans. Other major sources of loans were the Pag-IBIG/HDMF, NHA and rural/cooperative banks.

One in every four households owns a motor vehicle

The survey showed that about a quarter (24.3 percent) of households owned at least one vehicle. Among those households who owned vehicles, 54.9 percent owned motorcycles, followed by cars/AUV/SUV/vans (32.2 percent of households), tricycle (19.4 percent) and other vehicles for agriculture-related use such as motorized boats (4.1 percent), “kuliglig”—improvised motorized vehicles (1.9 percent), and tractors (0.8 percent).

One in seven households borrow to finance their motor vehicle purchases

About 13.5 percent of households that owned motor vehicles had outstanding loans on their vehicles. In-house financing was the most popular mode/source of motor vehicle loans.

Majority of households own various types of appliances

Majority of households (87.1 percent) owned various types of household appliances. On average, six different types of appliances can be found in any household. The most common appliances found in households were: television set, electric fan, cellphone/telephone, VCD/DVD player, gas stove, and refrigerator.

Eight in ten households are unbanked

Eight in ten households (78.5 percent) did not have a deposit account. Among those with no deposit accounts, the main reason cited by 92.8 percent of households for the absence of a deposit account was that they did not have enough money for bank deposits. Other reasons mentioned by the remaining 7.2 percent of households were: do not need a bank/cash account (1.7 percent), cannot manage an account (1.5 percent), minimum balance is too high (1.2 percent), do not like to deal with banks/financial institutions (1 percent), and others not specified (1.8 percent).

Eight in ten deposit accounts are placed in commercial banks

The most popular type of depository institution among households were commercial banks (77.3 percent). The remaining 22.7 percent were: rural/cooperative banks (8.0 percent), savings/thrift banks (5.3 percent), multipurpose/credit cooperatives (4.9 percent), microfinance banks (2.2 percent), savings and loan associations (1.3 percent), paluwagan (0.5 percent) and others (0.5 percent).

Only six in ten deposit accounts pay interest

Not all deposit accounts were interest-bearing. Only 6 in 10 households had interest-paying deposit accounts. This indicated that a significant number of deposit accounts had an average daily balance below the required amount to earn interest or had earned a negligible amount of interest.

Forty-three percent of respondents have one or more retirement plans

The survey showed that 42.7 percent of the total respondents had at least one retirement or insurance plan from both/either the government and/or private companies. A large proportion (93.9 percent) of respondents was covered solely by government insurance, such as SSS, Government Service Insurance System (GSIS), Armed Forces of the Philippines Savings and Loan Association Inc. (AFPSLAI), and others (e.g., Pag-IBIG, Public Safety Mutual Benefit Fund, and the Philippine Veterans Affairs Office); 4.5 percent by both the government insurance and private insurance companies; and 1.6 percent exclusively by private companies. Of the total insured not currently receiving pension benefits, 36.4 percent were paying their premiums while the remaining 63.6 percent were not.

Results of the survey showed that 44.9 percent of respondents’ spouses had at least one retirement or insurance plan from both/either the government and/or private companies. Among respondents’ spouses, SSS had the highest coverage among government insurers with a total of 91.9 percent, followed by the GSIS at 9.9 percent, and provident funds and other government insurers (e.g., AFPSLAI and Pag-IBIG) accounting for 8.7 percent of the total respondents’ spouses covered by insurance. Of the total insured not currently receiving pension benefits in the employment-based insurance, 52.5 percent were currently paying their premiums while the remaining 47.5 percent were not paying their premiums.

Three in ten household members are covered by health insurance

Only 3 in 10 household members (29 percent) were covered by health insurance. Of those covered, 93.6 percent were under Philhealth insurance, 4 percent under private health insurance and 2.4 percent under both private health insurance and Philhealth. These results indicated that Philhealth was able to cover less than one-third of household members and that the majority of the population has yet to be covered by health insurance.

The most common inheritance received by households is real estate

About 21 percent of households reported receiving an inheritance. The most common inheritance received was real estate such as land or farm (60.3 percent) and houses, condominiums and townhouses (23.9 percent). Households also received inheritance in cash, shares of stock and other financial assets (2 percent) as well as businesses, vehicles, and jewelries/antiques (2.1 percent).

Four percent of households have credit cards

About four percent of households had credit cards. In terms of the number of credit cards owned, majority of households (63.6 percent) reported having only one credit card.

About four in ten (38.9 percent) credit cards’ monthly bills were paid in full, another 39.8 percent were paid only the minimum amount, 4.8 percent were paid a partial amount other than the minimum, 1.2 percent were not paid at all, and 15.3 percent were unspecified.

One in five households avail themselves of other types of loans such as personal, salary, multi-purpose and business loans

Aside from real estate, housing, motor vehicle, and credit card loans, about one-fifth (20.9 percent) of households availed themselves of other types of loans such as personal, salary, multipurpose, and business loans. The said loans were sourced mostly from money lenders, cooperatives, financing institutions, SSS, and Pag-IBIG. These were used primarily for business start-ups and expansion, educational expenses, debt payment, medical, and house improvement expenses.

Wages and salaries are the main sources of household income

The main sources of household income were wages and salaries (43.2 percent of total households), businesses including self employment (40.6 percent), financial assistance from other households (19.8 percent) and financial assistance from abroad (19.6 percent).

Four in ten households own a farm or business

About 40.6 percent of households owned a farm or business. Businesses of households were mainly in wholesale and retail trade, and agriculture, hunting, forestry and fishing.

One in five households receives financial assistance from abroad

About one-fifth of households received financial assistance from abroad in the form of cash, gift, or other forms of transfers in 2008. The average amount received by each of these households was P48,988 a year, while the median amount was P12,000.

Median total income of households is P108,000

The average and median total income of households in 2008 were P188,350 and P108,000, respectively.

Food and beverage consumed at home is the main household expenditure

Food and beverages consumed at home accounted for 38.5 percent of the annual household expenditures. This was followed by rent (18.5 percent), transportation and communication (10.7 percent), utilities (7.2 percent), food and beverage consumed outside the home (6.7 percent), education (5.5 percent), medicine and medical services (5 percent), house repairs and maintenance (2.1 percent), clothing (1.4 percent), travel and recreation (1.5 percent), and celebration during special occasions, household help services, and purchase of furniture and appliances at 1 percent each.

Respondents are inclined towards saving

When asked “if they have surplus money, where they will put their extra money,” the top two answers of respondents were to save in banks (39.4 percent) and save cash at home (38.8 percent). This indicates that majority of the population has the inclination to save.

Majority of respondents are not risk takers when it comes to their income and business

Majority of respondents would not risk their income to undertake risk-taking activities that could increase their current level of income. About 7 in 10 respondents chose to stick to their current level of sure income of P1,500 per week rather than take the risk of investing in a new product with a 50-50 chance of either getting P4,500 (three times their current income) or suffer a loss of P1,500 (equal to their current income).

Survey results affirm relevance of BSP’s financial inclusion and financial education initiatives

Some policy implications that can be drawn from the results of the survey are: first, the BSP should continue to work toward a more inclusive financial system that reaches to those who are otherwise “excluded” or “unbanked”. To this end, the BSP has already made some headway in promoting and establishing an enabling policy and regulatory environment to increase access to financial services of the entire populace through policy and regulatory initiatives, training and capacity building, and promotion and advocacy activities.

Second, there is a need to continue to educate Filipino households on the advantages of saving in financial institutions and investing in various forms of financial instruments. For more than a decade, the BSP has been conducting financial learning seminars in different provinces all over the country. In 2010, it formulated an Economic and Financial Learning Program to integrate its various learning programs, which are aimed at promoting general awareness and understanding of important economic and financial issues to help the public acquire the knowledge and develop the skills needed to make well-informed decisions and choices.

Third, there is a need to look into “shadow banking” transactions and related regulatory and supervisory approaches to monitor system-wide risk exposure to particular sectors without reducing credit opportunities for consumers.

Finally, the BSP should liaise with government pension systems to encourage membership, and regular/timely payment of premiums to national pension and retirement funds among household members who are self-employed and unemployed.

The results of the survey affirm the relevance of the BSP’s commitment to financial inclusion─the provision of a wide range of financial services (credits, savings, payments, insurance) to serve the demands of different market segments; the availability of financial products appropriately designed , priced, and tailor-fitted to market needs and capacities; the participation of a wide variety of strong and sound institutions to provide financial services to more Filipinos; and the effective interface of bank and non-bank products/delivery channels, technology and innovation to reach the financially excluded. The survey results also attest to the importance of the BSP’s advocacy for inclusive and proactive economic and financial education among its stakeholders.

realistically, what are the chances of a student with a measly 300 per week allowance of being able to significantly invest in say…..dividends and/or investment funds here in the phils.? hoping for your reply soon

P300/week for a student is not realistic to be able to invest. However, a determined and enterprising student will take on odd jobs, start a sideline business, etc. to earn extra money to invest. It requires only P5,000 initial investment to get started in investing in stocks or mutual funds. A part-time job or business can generate P5,000 in a month or two, so it’s possible for even a student to invest.

Pingback: Finance 101: I Save to Invest | Warjie Malibago